"An investment in knowledge pays the best interest"

- Benjamin Franklin -

New Mobile App Release – April 2023

New App Release April 2023 – Introducing the New Required Income…

New Mobile App Release – February 2023

New App Release February 2023 – Our first release of 2023…

Looking at the Possible New Mortgage Rules on the Way

Looking at the Possible New Mortgage Rules on the Way Canada’s…

Borrowing Money from Your Home: Mortgage vs. HELOC

Borrowing Money from Your Home: Mortgage vs. HELOC Do you want…

Real Estate Predictions for 2023

Real Estate Predictions for 2023 With a new year, it’s always…

The Top Real Estate Stories of 2022

The Top Real Estate Stories of 2022 2022 was quite an…

The Mortgage Stress Test with the Canadian Mortgage App

The Mortgage Stress Test with the Canadian Mortgage App Canada’s banking…

Property Taxes with the Canadian Mortgage App

Property Taxes with the Canadian Mortgage App Nobody enjoys paying taxes,…

Calculate Non-Resident Speculation Tax

Calculate Non-Resident Speculation Tax with the Canadian Mortgage App In this…

Closing Costs with the Canadian Mortgage App

Closing Costs with the Canadian Mortgage App Are you looking to…

Mortgage Pre-Approval Rate Hold with the Canadian Mortgage App

Mortgage Pre-Approval Rate Hold with the Canadian Mortgage App Are you…

Payment Frequencies with the Canadian Mortgage App

Payment Frequencies with the Canadian Mortgage App Are you looking for…

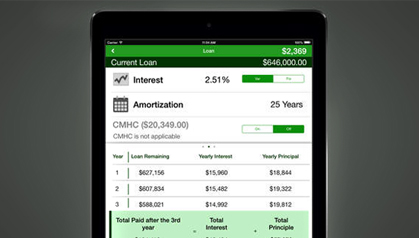

Amortization Schedule with the Canadian Mortgage App

Amortization Schedule with the Canadian Mortgage App Do you understand the…

Comparing Mortgage Options with the Canadian Mortgage App

Comparing Mortgage Options with the Canadian Mortgage App Are you considering…

How much do you “actually” save when you pay your Mortgage sooner?

How much do you “actually” save when you pay your Mortgage…

Higher Home Purchase Price with Self-Employed Income

Higher Home Purchase Price with Self-Employed Income Are you self-employed and…

Higher Home Purchase Price with Net Worth Programs

Higher Home Purchase Price with Net Worth Programs Are you someone…

Higher Home Purchase Price with Non-Subject Properties

Non-Subject Properties: Qualifying for a Higher Home Purchase Price Are you…

Property Taxes: Qualifying for a Higher Home Purchase Price

Property Taxes: Qualifying for a Higher Home Purchase Price You’d think…

Buying a Rental Property When Living at Home: Qualifying for a Higher Home Purchase Price

Buying a Rental Property When Living at Home: Qualifying for a…

Higher Home Purchase Price with Student Debt

Life with Student Debt: Qualifying for a Higher Home Purchase Price…

Higher Home Purchase Price without the Mortgage Stress Test

No Mortgage Stress Test: Qualifying for a Higher Home Purchase Price…

Higher Home Purchase Price with Rental Income

Rental Income: Qualifying for a Higher Home Purchase Price Are you…

Higher Home Purchase Price by Extending Your Mortgage Amortization

Extending Your Mortgage Amortization: Qualifying for a Higher Home Purchase Price…

Higher Home Purchase Price by Reducing Your Debts

Reducing Your Debts: Qualifying for a Higher Home Purchase Price In…

Higher Home Purchase Price with Extended Debt Ratios

Debt Ratios: Qualifying for a Higher Home Purchase Price This will…

Mortgage Rates are Rising: How It May Impact You

Mortgage Rates are Rising: How It May Impact You Variable mortgage…

Rates have increased again. What to do?

Rates have increased again. What do you do? Mortgage rates have…

What is the Trigger Rate?

What is the Trigger Rate and Why Does it Matter? In…

How Do I Correct a Mistake on My Credit Report?

How Do I Correct a Mistake on My Credit Report? Do…

Other Factors to Consider Besides Just the Rate

Other Factors Besides Just the Rate When it comes to mortgages,…

How to Qualify for a Mortgage When You’re Newly Self-Employed

How to Qualify for a Mortgage When You’re Newly Self-Employed A…

Is Credit Monitoring and Identity Protection Worth It?

Is Credit Monitoring and Identity Protection Worth It? Are you considering…

Getting a Mortgage After a Bankruptcy or Consumer Proposal

Getting a Mortgage After a Bankruptcy or Consumer Proposal Getting a…

Understanding the Different Types of Credit

Understanding the Different Types of Credit We all know credit cards,…

The Flex Down Payment Mortgage: Buying a Home with No Money Down in Canada

The Flex Down Payment Mortgage: Buying a Home with No Money…

Renting Your Property to a Family Member: Should You Do It?

Renting Your Property to a Family Member: Should You Do It?…

Soft vs. Hard Credit Inquiry: What’s the Difference?

Soft vs. Hard Credit Inquiry: What’s the Difference? There are two…

Gifted Down Payment: The Bank of Mom and Dad

Gifted Down Payment: The Bank of Mom and Dad In this…

Everything You Wanted to Know About Credit Reports

Everything You Wanted to Know About Credit Reports Credit reports were…

Raw Land Mortgage Financing

Everything you Wanted to Know About Raw Land Mortgage Financing Are…

How to Protect Yourself from Identity Theft

How to Protect Yourself from Identity Theft Each year thousands of…

How to Get a Mortgage When you’re Self-Employed

How to Get a Mortgage When you’re Self-Employed There’s a misconceptions…

Cryptocurrency and Real Estate: Buying and Selling a Home in Crypto

Cryptocurrency and Real Estate: Buying and Selling a Home in Crypto…

Buying a Second Home

Buying a Second Home Are you considering buying a second home?…

How to Transfer Your Mortgage

How to Transfer Your Mortgage This article will look at why…

What will be the Impact on the Real Estate Industry if Mortgage Rates Rise?

What will be the Impact on the Real Estate Industry if…

What is the Deposit?

What is the Deposit? In this article, we’ll look at what…

Maternity/Paternity Leave and Mortgage Financing

Maternity/Paternity Leave and Mortgage Financing Are you planning to buy a…

What is a Mortgage Interest Adjustment?

What is a Mortgage Interest Adjustment? This article will look at…

Common Credit Score Mistakes and How to Avoid Them

Common Credit Score Mistakes and How to Avoid Them Every day…

What are the Different Types of Insurances for Homeowners?

What are the Different Types of Insurances for Homeowners? Here are…

Why the Mortgage Stress Test Could Still Affect you in 2022

Why the Mortgage Stress Test Could Still Affect you in 2022…

What is an Alternative Lender and Why Might I Need One?

What is an Alternative Lender and Why Might I Need One?…

What is Your Down Payment and Why Does It Matter?

What is Your Down Payment and Why Does It Matter? Are…

What are the Most Common Closing Costs?

What are the Most Common Closing Costs? Don’t forget about closing…

Can We Expect Mortgage Rates to Rise in 2022?

Can We Expect Mortgage Rates to Rise in 2022? Are you…

What to Expect from the Coming Immigration on the Real Estate Market

What to Expect from the Coming Immigration on the Real Estate…

What is a Private Lender and Why Might I Need One?

What is a Private Lender and Why Might I Need One?…

How Much Can I Afford? Mortgage Debt Ratios

How Much Can I Afford? Mortgage Debt Ratios Are you ready…

Everything You Wanted to Know About Cashback Mortgages

Everything You Wanted to Know About Cashback Mortgages Are you considering…

Even More Common Mortgage Questions Answered

Even More, Common Mortgage Questions Answered In our third instalment of…

3 More Common Mortgage Questions Answered

3 More Common Mortgage Questions Answered Last week we went over…

3 Common Mortgage Questions Answered

3 Common Mortgage Questions Answered When it comes to mortgages, sadly,…

What is Rent to Own?

What is Rent to Own? You may have heard of the…

3 Red Flags to Watch Out for When Buying a Home

3 Red Flags to Watch Out for When Buying a Home…

What’s Causing the Real Estate Market Slowdown?

What’s Causing the Real Estate Market Slowdown? The Canadian real estate…

The Different Types of Lenders – Banks vs. Credit Unions vs. Monolines

The Different Types of Lenders – Banks vs. Credit Unions vs.…

How can I Afford a Higher Home Purchase Price?

How can I afford a higher Purchase Price? Are you hoping…

Buying a Family Cottage

Buying a Family Cottage Are you considering buying a cottage? You’re…

4 Common First-Time Homebuyer Mistakes to Avoid

4 Common First-Time Homebuyer Mistakes to Avoid Are you a first-time…

How to Improve and Keep a Good Credit Score

How to Improve and Keep a Good Credit Score Are you…

Why You Should Get a Home Inspection

Why You Should Get a Home Inspection When you see a…

How to Save Money on Home Insurance

How to Save Money on Home Insurance Is your home insurance…

Variable Rate vs. Adjustable Rate Mortgages

Variable Rate vs. Adjustable Rate Mortgages When considering mortgage options, the…

Mortgages and Divorce

Mortgages and Divorce Are you recently separated or divorced, or are…

How are Mortgages Priced?

How are Mortgages Priced? Have you ever taken out a mortgage…

Home Inspection vs. Appraisal

Home Inspection vs. Appraisal Do you know the difference between a…

Pre-Qualified vs. Pre-Approved vs. Approved

Pre-Qualified vs. Pre-Approved vs. Approved If you’re considering buying a home,…

Qualifying for a Rental Property with Rental Income

Qualifying for a Rental Property with Rental Income Are you considering…

Mortgage Prepayment Privileges: Paying Down Your Mortgage Sooner

Mortgage Prepayment Privileges: Paying Down Your Mortgage Sooner Are you looking…

How Mortgage Penalties Work

How Mortgage Penalties Work When shopping for a mortgage, many of…

25 Year vs. 30 Year Amortization: Which Should I go with?

25 Year vs. 30 Year Amortization: Which Should I go with?…

What is the difference? Open & Closed Mortgage

The difference between an Open and Closed Mortgage When you’re signing…

New Mortgage Stress Test on the Way

New Uninsured Mortgage Stress Test Likely on the Way Canada’s top…

Reason #1 to Refinance: Consolidate Debt

Reason #1 to Refinance: Consolidate Debt In last week’s blog post…

Reason #2 to Refinance: Lower My Payments

Reason #2 to Refinance: Lower My Payments In last week’s blog…

Reason #3 to Refinance: Pull Out Equity

Reason #3 to Refinance: Pull Out Equity Do you want to…

Reason #4 to Refinance: Saving on Interest

Reason #4 to Refinance: Saving on Interest Did you sign up…

Why Might You Refinance Your Mortgage?

Why you might Refinance your Mortgage You may have heard of…

Everything You Wanted to Know About Collateral Mortgages

Everything You Wanted to Know About Collateral Mortgages You may have…

Build More Relationships with Realtors in 2021 with PRO Plus

Build More Relationships with Realtors in 2021 with PRO Plus Are…

Everything You Wanted to Know About Mortgage Default Insurance

Everything You Wanted to Know About Mortgage Default Insurance If you’re…

Home Exit Strategies

Home Exit Strategies Are you considering exiting the real estate market?…

Should You Get a Co-Signer On Your Mortgage?

Should You Get a Co-Signer On Your Mortgage? Are you looking…

How to Save Money Changing Your Payment Frequency

How to Save Money Changing Your Payment Frequency There’s a misconception…

What is a Reverse Mortgage?

Canadian Reverse Mortgages If you’re a senior who’s short on cash…

Which Mortgage Lender is the Best?

Which Mortgage Lender is the Best? One of the most important…

How Lenders Price Mortgages

How Lenders Price Mortgages Have you ever wondered why your friend…

3 Simple Ways to Pay your Mortgage Sooner

3 Simple Ways to Pay your Mortgage Sooner Do you dream…

Shopping for a Mortgage

Top 5 important things when Shopping for a Mortgage One of…

Mortgage Term vs Amortization

Mortgage Term vs Amortization When you’re applying for a mortgage, it’s…

Fixed vs Variable Mortgages

Fixed vs. Variable Rates A decision a lot of homebuyers and…

How Mortgage Penalties are Calculated

How Mortgage Penalties are Calculated When you’re shopping for a mortgage,…

What makes a Mortgage Broker Successful

What makes a Mortgage Broker Successful Success in the Mortgage Industry…

Compounding in Mortgages

How Mortgage Compound Interest Works Do you find compound interest complicated?…

What is the Mortgage Stress Test?

Canadian Mortgage Stress Test When we plan our future, we prepare…

Stress Test Rate Falls to 4.79%

Stress Test Rate Falls to 4.79% On August 12th, 2020, The…

How to Buy a Home Virtually

How to Buy a Home “Virtually” For the past few months,…

CMHC New Mortgage Underwriting Policies

CMHC New Mortgage Underwriting Policies Effective July 01, 2020 CMHC (Canada…

Home Buying Process During COVID19

Home Buying Process During COVID19 The past few months have been…

Impact of Remote Working in Real Estate

Impact of Remote Working in Real Estate We are living through…

2020 Quebec Land Transfer Tax

2020 Québec Land Transfer Tax What is a Land Transfer Tax? …

Taxe de Bienvenue du Quebec 2020

Taxe de Bienvenue du Québec 2020 Qu’est-ce qu’un droits de mutation?…

How to Manage Your Mortgage During a Crisis

How to Manage Your Mortgage During a Crisis The year 2020…

Your 2020 Homeownership Resolution

Your 2020 Homeownership Resolution A new year is a time to…

Banks VS Mortgage Brokers

Your 2020 Homeownership Resolution There are different ways to get a…

Incentive for First-Time Homebuyers

Incentive Program for First-Time Homebuyers As a first-time homebuyer, the chance…

Breaking Down Pre-Qualification

Breaking Down Pre-Qualification Pre-Qualification The excitement that comes with shopping for…

Your Data & How it’s Analyzed

Your Data & How it’s Analyzed Each property type requires different…

What are my Closings Costs

What are my Closing Costs The process from prospective buyer to…

How to Calculate Your Actual Monthly Cost

How to Calculate your Actual Monthly Cost One of the big…

Collateral, Convertibles and Cash back

Collateral, Convertibles and Cash back If you didn’t already guess, they…

Tips for More Living Space

Tips for More Living Space When looking for a new residence,…

Need More Options when it Comes to your Mortgage?

Need More Options When it Comes to Your Mortgage? It is…

How to Promote your App

How to Promote Your App Some professionals have asked, “what is the…

Securing a Mortgage as Self-Employed will get Easier

Securing a Mortgage as Self-Employed will get Easier Being self-employed comes…

2 Easy ways to pay off your mortgage early

2 Easy ways to pay off your Mortgage Early A simple…

Top 3 Advantages of CMA PRO

Top 3 Advantages of CMA PRO CMA PRO is an extremely…

Canadian Mortgage App to the Rescue

Canadian Mortgage App to the Rescue Mortgage transactions have always been…

CMA PRO’s partners with local expert

CMA PRO’s partners with local expert The number of partners in…

CMA Client Analytics Report

CMA Client Analytics Report The number of clients in the analytics…

CMA Download Report

CMA Download Report The number of downloads represents the number of…

The Canadian Mortgage App: Simplifying The Home Buying Process

The Canadian Mortgage App: Simplifying The Home Buying Process The Canadian mortgage…

Mobile Innovation Changing The Game For Brokers

Mobile Innovation Changing The Game For Brokers The Canadian Mortgage App’s…

Recognizing Success In Canada’s Mortgage App Market

Recognizing Success In Canada’s Mortgage App Market After three years of…

Brokers Get Access To PRO APP Add-On

PRO App for Brokes Building an app is not cheap. In…

Why You Need To Embrace Technology

Why You Need To Embrace Technology Millennials expect to be able…

Sell Your Next Mortgage… On Your Phone

Sell Your Next Mortgage… On Your Phone When Ben Salami was…

Canadian Mortgage Awards 2016!

Canadian Mortgage Awards 2016 The Canadian Mortgage App team was extremely…

Advertise As A Mortgage Local Expert

Advertise as a Local Expert New Local Experts We know you…

Extra Payment Analyzer

Extra Payment Analyzer Can you pay off your mortgage sooner? Over…

GDS / TDS Ratios

GDS / TDS Ratios How does it work… Previously, we told…

Calculate your Affordability

Calculate your Affordability …. with Credibility Buying a home is…

Closing Costs

Closing Costs Now available on CMA We all know that the…

We Did It For BlackBerry

We Did it For BlackBerry We know Blackberry users love their keyboards 🙂…

The 2015 Canadian Mortgage Awards

2015 Canadian Mortgage App Awards The 2015 CMAs took place in…

Amazing Milestone!

Amazing Milestone! We couldn’t have done it without you! Thank you…