CMA Features

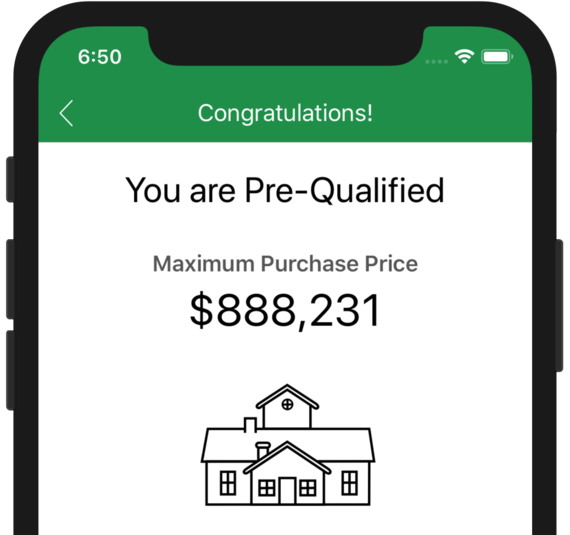

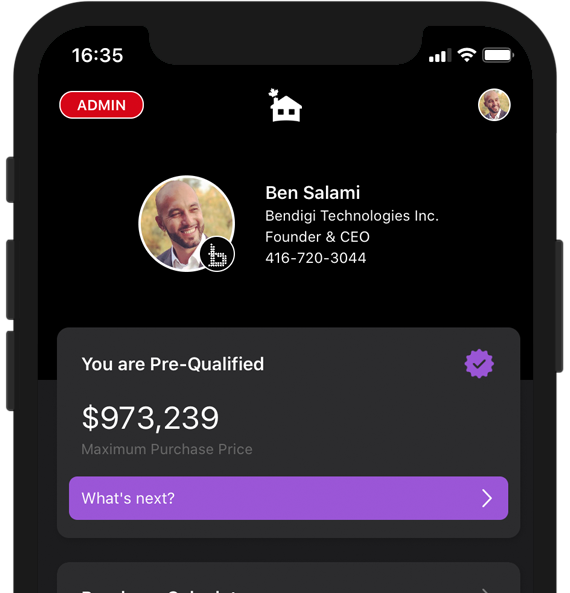

Get Pre-Qualified in seconds

What can you afford?

Calculate the maximum home price you can afford without affecting your credit. Generate a detailed report that you can share with your Realtor or Mortgage Broker.

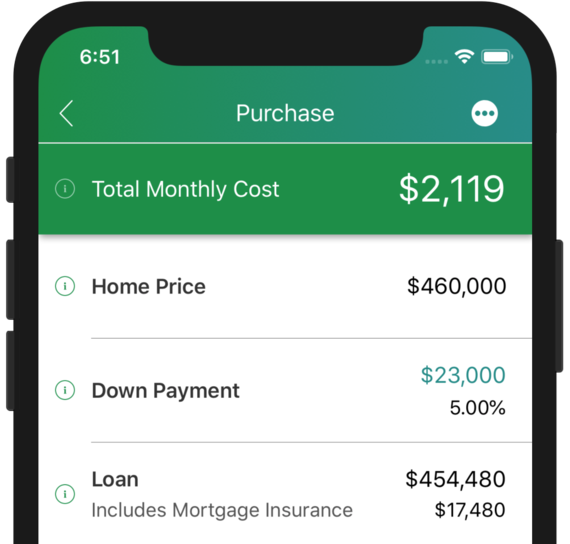

Budget Better Easier Faster

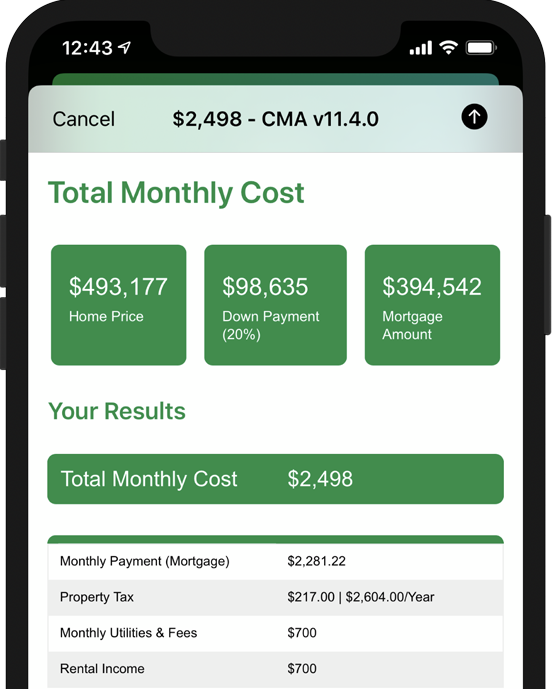

What is your monthly cost?

Our Purchase Calculator doesn’t just stop at mortgages. We’ll take into account all your home ownership expenses.

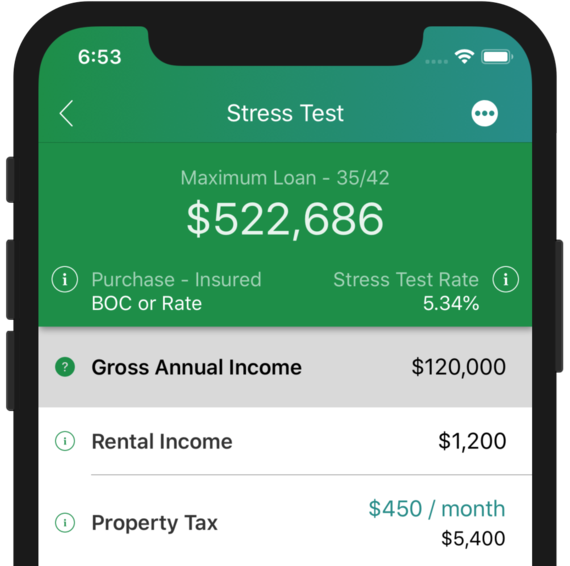

No Stress with Stress Test

Stress Test your purchase like a pro with the first and only app (so far) that has the B20 Guidelines and real rental income rules

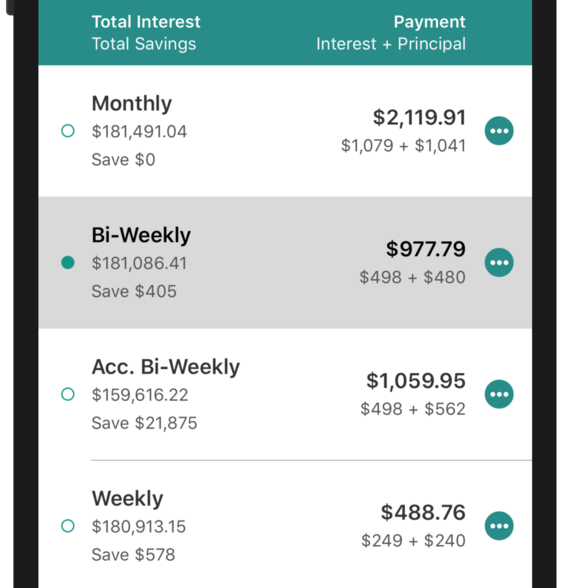

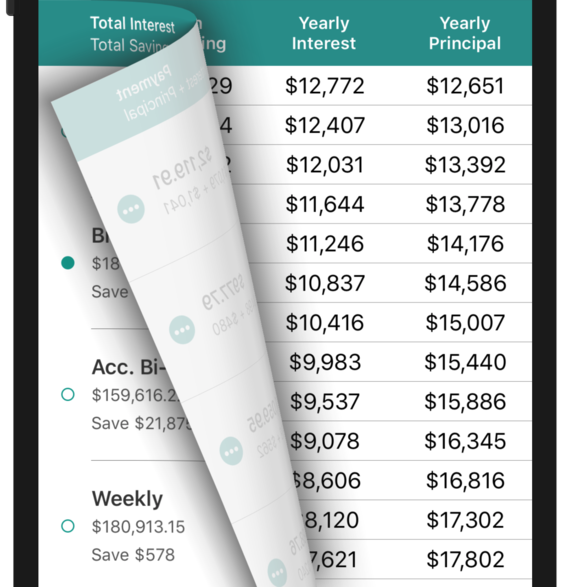

View All Payments

Calculate payments in real time for all payment frequencies and see how much interest you pay or how much you save over the term of your mortgages.

Analyze with just a swipe

View how much mortgage you have left in every year over the term or full life of your mortgages.

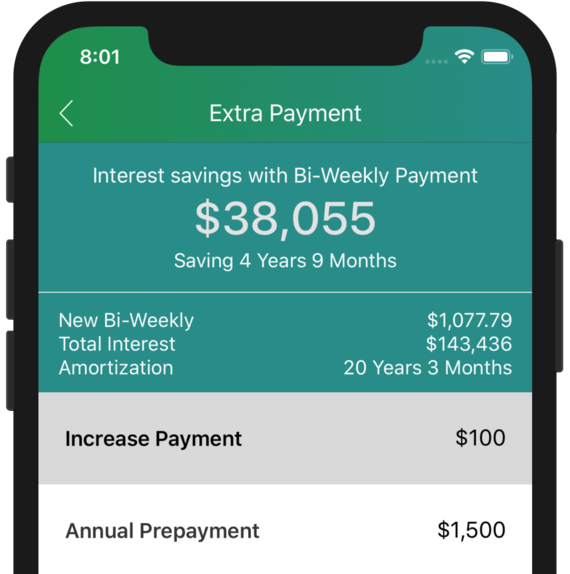

What if you increase payments?

View Savings

Increase payments by a percentage, a custom amount or apply a lump sum and find out how much interest and time you’ll save.

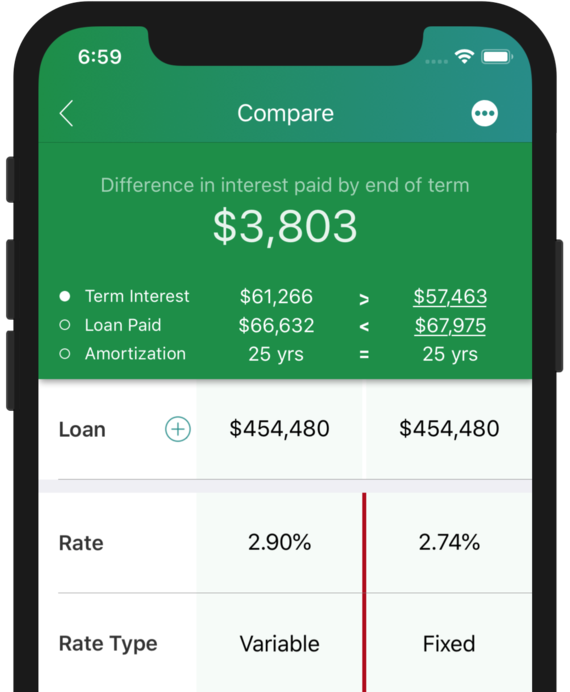

Compare scenarios side by side and win

Which option saves more?

Place two scenarios side by side and change as many variables as you like. Instantly calculate differences in interest, loan paid or time savings.

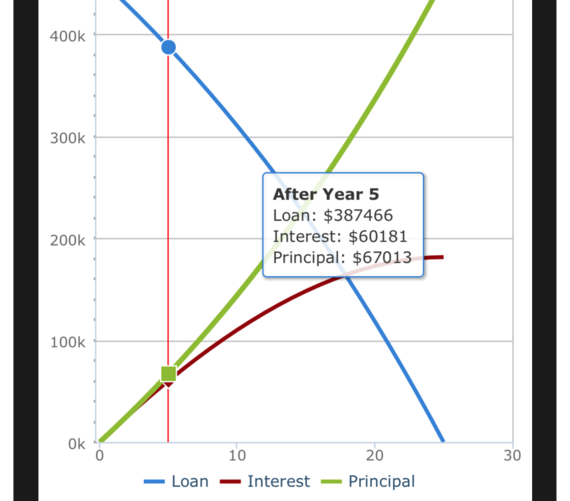

Beautiful Visualizations

Amortization Graph

Visualize how loan, interest and principal behave over time. Run your finger on the graph to extra more information.

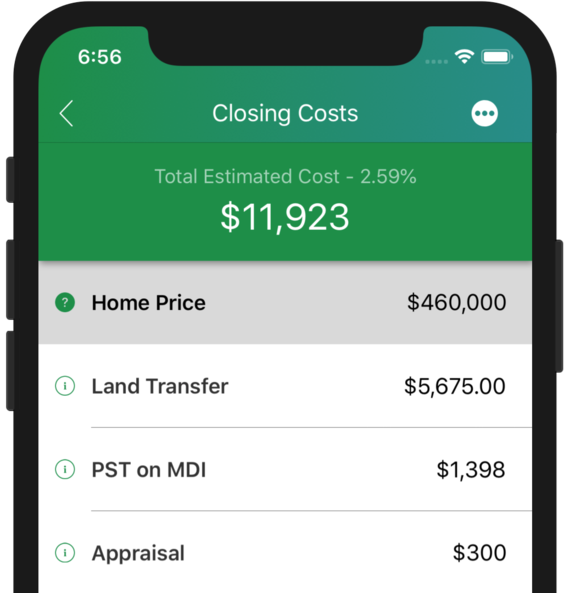

Avoid surprises with true closing costs

How much cash do you really need?

Our Closing Cost calculator has been developed with the consultations of thousands of professionals.

Made in Canada

by Canadians for Canadians

Land Transfer Taxes and Rebates

We support all our Canadian Land Transfer Taxes, first time home buyer rebates and foreign-buyer tax calculations. That’s more than 100+ municipality rules and regulations.

Beautiful Reports

Export PDF's Reports

Canadian Mortgage App reports can cover a wide range of topics, from your total monthly costs, amortization table, land transfer and closing costs among many others.

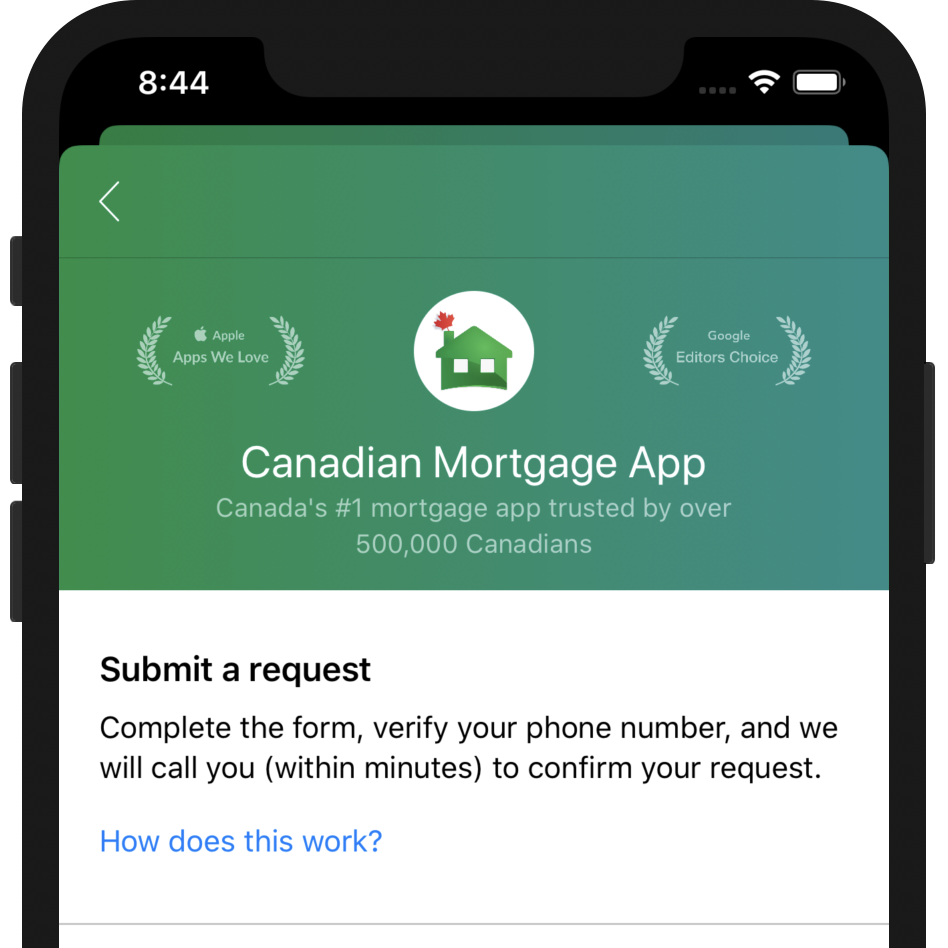

Get in Contact with a Mortgage Professional

Speak with a Mortgage Broker

Whether you need a pre-approval, looking to renew your mortgage or refinance, the Canadian Mortgage App is introducing a new modern way to request to speak with one of our mortgage partners.

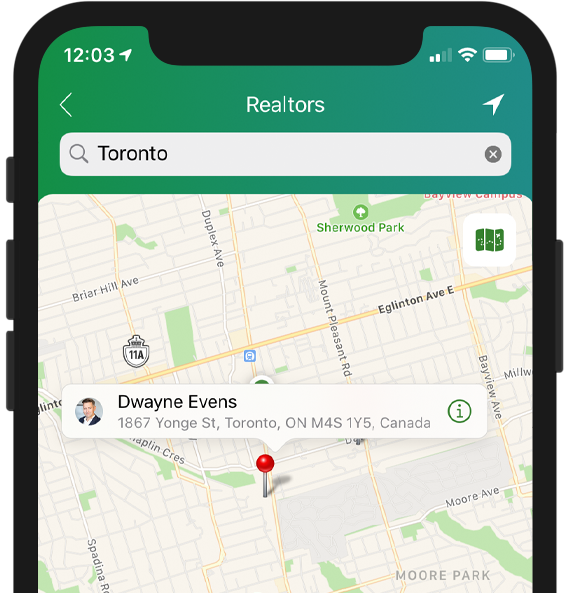

Local Experts

You can now find Local Experts (Realtors or Mortgage Brokers) any time, any place from your phone.

Just type in your city, their name or company, and our app will magically display nearby expert.

Push Notifications

Receive Alerts in your Phone

This is great for improving your user experience with the Canadian Mortgage App. You can recieve relevant and personalized content.

Other Features

Dark Mode, Other Languages and More

We are always adding new tiny enhancements to improve your experience. Dark Mode, Other Languages and more customizations.

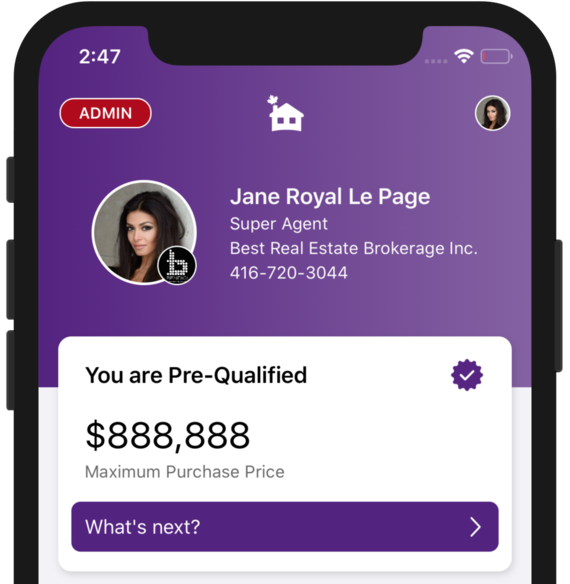

Are you a Realtor or a Mortgage Broker?

You'll love the Personalizations

Our PRO subscription lets you personalize CMA and offer it to your clients, stay in touch and generate new business with our Local Expert listing.

Elevator Pitch

Quick summary of things you can do

Report Explained

1. Home Buyers

You can easily calculate your payments, calculate minimum down payments, basically calculate everything there is about mortgages. You can also get pre-qualified, create beautiful reports that you can share with your Realtor or Mortgage Brokers, you can track and monitor latest mortgage rates and when ready make a mortgage request to speak to an expert.

2. Realtors

You can use like a Home Buyer and more. You can go further and personalize the app and offer clients your branded version of Canada’s #1 mortgage app.

Your clients will just love you for it because it’ll help them to plan out their purchase. You can ask them to get pre-qualified and request the report to save time before showing any homes. Your special admin console, lets you stay connected with your users via a mini CRM and track analytics.

Additionally, we offer you ad space on our local expert listings where we advertise you to thousands of home buyers.

3. Mortgage Brokers

You can use like a Home Buyer and more. You can go further and personalize the app and offer clients your branded version of Canada’s #1 mortgage app.

Your clients will just love you for it because it’ll help them to plan out their purchase. You can ask them to get pre-qualified, get notified and review their report with them. You get all the mortgage requests and all user generated reports from the app. Your special admin console, lets you stay connected with your users via a mini CRM and track analytics.

Additionally, we offer you ad space on our local expert listings where we advertise you to thousands of home buyers.

4. Brokerages

Looking for a custom app with more branding? Our parent company Bendigi Technologies develops mobile apps for larger brokerages based on your unique requirements. We have published many apps for some of the top brokerages in Canada including Collin Bruce Team (DLC), Butler Mortgage (Verico), Loewen Group (RMG) and many many others. We publish your custom mortgage app under your brokerage name and your agents can further send their clients unique install links that will identify them as their favourite agent.

Networks

Have over 500 agents? You can take a completely white labeled mobile app based on the Canadian Mortgage App’s code base. Additionally, we will deploy a standalone private backend for you that will sync with your database of agents. From authentication to rates, it’ll be all driven by you. Your agents will all receive an individually branded version of your network app and all the resources you’d like to offer to them.

Lenders

Industry Service Providers